According to Forbes, there have been more than 230 corporate bankruptcy filings in the United States in 2023, which is apparently more than twice the number of filings in the same period last year. Rising costs and supply chain disruptions have caused a lot of global instability. In Kenya the central bank raised interest rates to 10.5% in June of this year, which made borrowing costs the highest they have ever been since August 2016.

It is no secret that rising borrowing costs is a blow towards consumer and business spending. For startups and businesses, rising inflation can have significant implications, including increased costs, reduced profit margins, and uncertain market conditions. But here is the thing; it is possible to beat inflation and steer your startup or business towards sustainable growth. After all, smooth seas never made good sailors. How can modern business leaders do this? Read along.

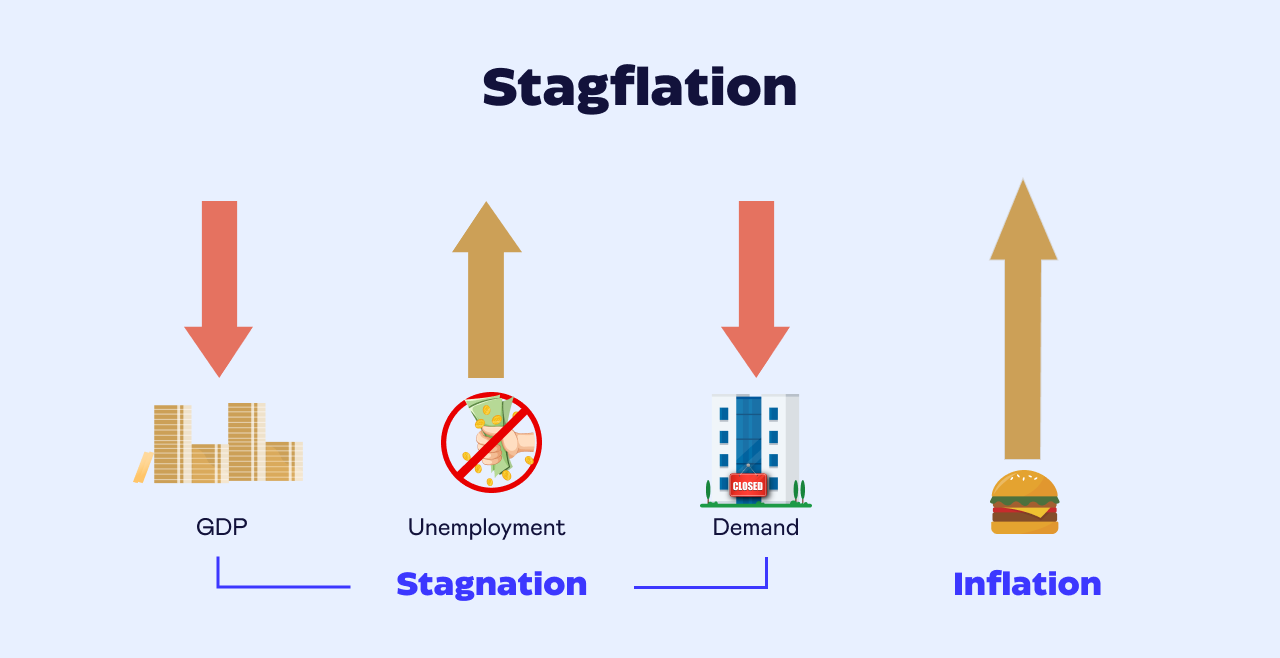

Inflation and Stagflation

Inflation is an economic phenomenon that affects the purchasing power of consumers and businesses alike. Consumers feel the pinch of higher prices in the store as their purchasing power is lower, and businesses can run out of cash and market share. It is thus defined as the general rise in the cost of goods and services over time. As mentioned earlier, rising interest rates often follow, as central banks try to slow down the economy.

Stagflation happens when you combine inflation and a general stagnation of an economy. The tell-tale signs of stagflation include rising prices for goods and services, rising interest rates, relatively high unemployment, and slow to no economic growth. Sound familiar? Stagflation hit 5 decades ago, and 16 Latin American countries stopped paying their debt payments. Last year, Sri Lanka defaulted on its loans, which led to protests and government shutdown. Developing nations are the hardest hit because of a reliance on exports and enormous sovereign debts. According to former World Bank President David Malpass, “The war in Ukraine, lockdowns in China, supply-chain disruptions, and the risk of stagflation are hammering growth.”

However, it’s easy to be pessimistic and gloomy when you turn on the TV. We live in a paradox, and the silver lining is that by almost every single measure, humanity is better off now than it’s ever been. We are generally richer, live longer, are more protected, better informed and more prosperous than any time in human history. The information age has opened infinite possibilities that can’t be ignored.

6 ways you can become recession-proof

-

Review your Pricing Strategies

Startups and businesses should periodically review their current pricing strategies. Consider conducting a thorough analysis of your cost structure, profit margins, and adjust your prices accordingly to ensure they align with the prevailing market conditions. However, it is crucial to strike a balance between maintaining customer loyalty and ensuring profitability during inflationary periods. Strategies such as bundle pricing and price segmentation can help you offer your customers more value for money and also help you target a wider customer base.

-

Strengthen Supplier Relationships

Inflation can cause suppliers costs to raise costs, which can put additional pressure on your business. Building strong relationships with your suppliers is vital in such circumstances. Open communication and negotiation are key as you should negotiate long-term contracts and explore the possibility of bulk purchases to secure good prices and ensure a stable supply chain. Collaborative partnerships with reliable suppliers can provide your startup with a competitive advantage in managing inflationary pressures.

-

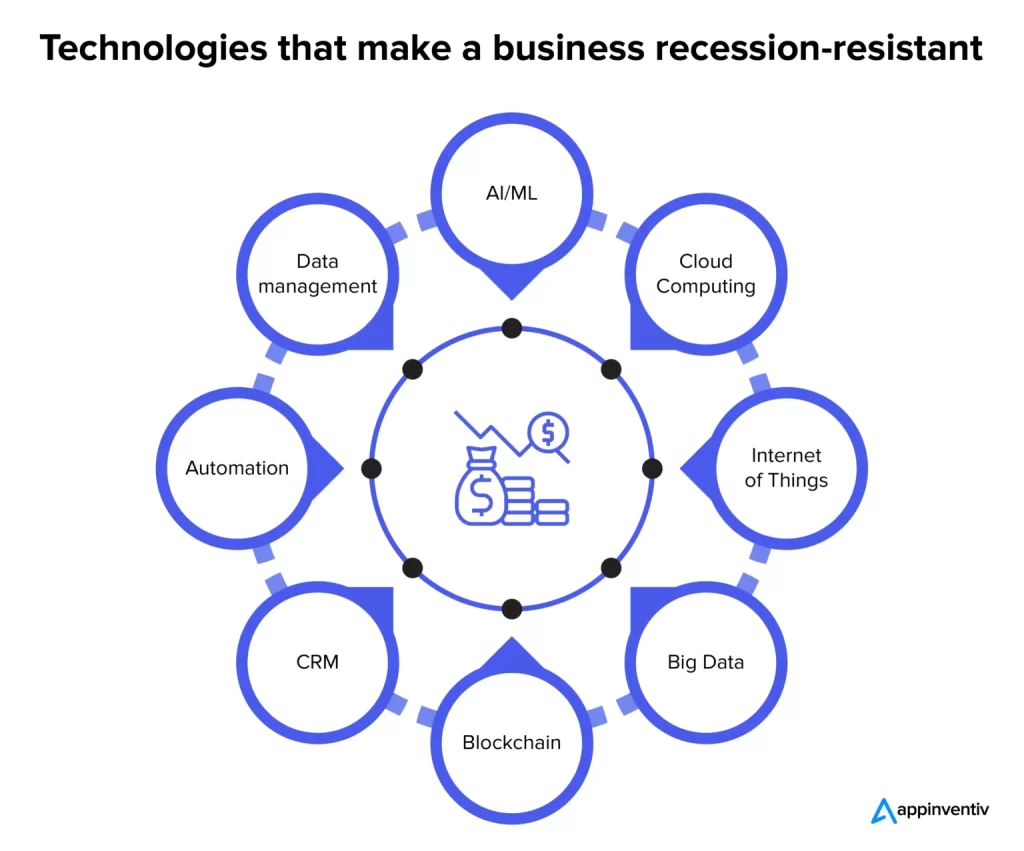

Optimize Operational Efficiency

Improving operational efficiency is crucial in combating the effects of high costs. Startups and businesses should regularly assess their internal processes to identify areas where costs can be reduced, or efficiencies can be gained. Implement lean management practices, automate repetitive tasks, outsource non-essential functions and explore technological solutions that can streamline operations and enhance productivity. This should help you balance out the impact of rising costs and maintain a healthy bottom line. Drop some load out of the boat to stay afloat.

How to recession proof your business? (Hint: Invest in technology) -

Diversify Revenue Streams

Relying heavily on a single product or service can leave you vulnerable, and your main cash cow can start pumping sour milk. To mitigate this risk, focus on diversifying your revenue streams. You can explore new markets, target different customer segments, or expand your product/service offerings. Being innovative and having a growth mindset is a powerful way to survive inflated prices and test your leadership skills. By diversifying, you can create a buffer against inflation by spreading risks and tapping into alternative revenue sources that may be less affected by rising prices.

-

Invest in Talent Development

Talent acquisition and retention are critical for startups and businesses to sustain growth during inflationary periods. Skilled employees can contribute significantly to improving operational efficiency and driving innovation. Invest in training and development programs to enhance the skill sets of your existing workforce. This not only strengthens your team but also increases employee loyalty and reduces the likelihood of turnover. Furthermore, you also want to attract and keep top talent by offering competitive compensation packages. Your workforce is your best asset.

-

Monitor and Adapt to Inflation Sources

Continuous monitoring of market trends, consumer behavior, and economic indicators is essential to respond effectively to inflationary pressures. As a leader, it is important to keep an eye on the road ahead. This is one of the core tenets of adaptive leadership. Stay updated on inflation rates, industry-specific dynamics, and shifts in consumer preferences. This information will enable you to adapt your strategies while making informed business decisions and implementing timely adjustments to product offerings, pricing, and operational plans.

Also Read: Productivity Hacks For Managers: The secrets of Parkinson’s Law

Conclusion

The main takeaway is that your leadership skills and mindset will lead you through any challenges you may face with your startup or business. The ability to adapt, become more efficient, foster meaningful connections and invest in your workforce will see you through external inflationary pressures. Partner with us for programs in leadership development and business strategy.