Tackling ESG issues paves the way into the future for long-term success and value creation. This means that ESG reporting, and sustainability prioritization are no longer the sole responsibility of an organization’s sustainability executive or other designated corporate executives. Investors now expect that the board of directors are actively engaging on ESG issues. Companies with robust board oversight tend to do a better job overseeing ESG risks.

It is therefore imperative that the board of directors attains ESG expertise and fluency. The board oversees the organization’s ESG strategy and ensures that it is well aligned with the overall strategy and evaluate its effectiveness in addressing ESG issues. Now more than ever, board members must take up sustainability leadership. Let’s explore the role of the board of directors in ESG reporting and how you too can adopt in-house ESG reporting.

The Outdated Financial Performance Model

While companies still face financial pressures from many sides resulting from the pandemic, boards must also have long term strategic goals. Self-preservation and staying alive is paramount. However, having a long-term view of the world could help companies address financial pressures. Besides, incorporating ESG issues like climate change and income inequality could help companies that have traditionally focused on financial performance to attract investors.

Also Read: How To Get Sustainable Business Success with the ESG Framework

Most CEOs now recognize that ESG issues should inform their corporate strategy. In addition, CEOs are tasked with the responsibility of developing their corporate board members with skills that address ESG matters. However, corporate boards assigned with safeguarding the future of their company frequently hinder progress. Unlike their evolved counterparts, they often cling to the outdated financial performance model of maximizing short-term value. ESG reporting and scoring ties into company value too. This is the new standard that we are seeing today.

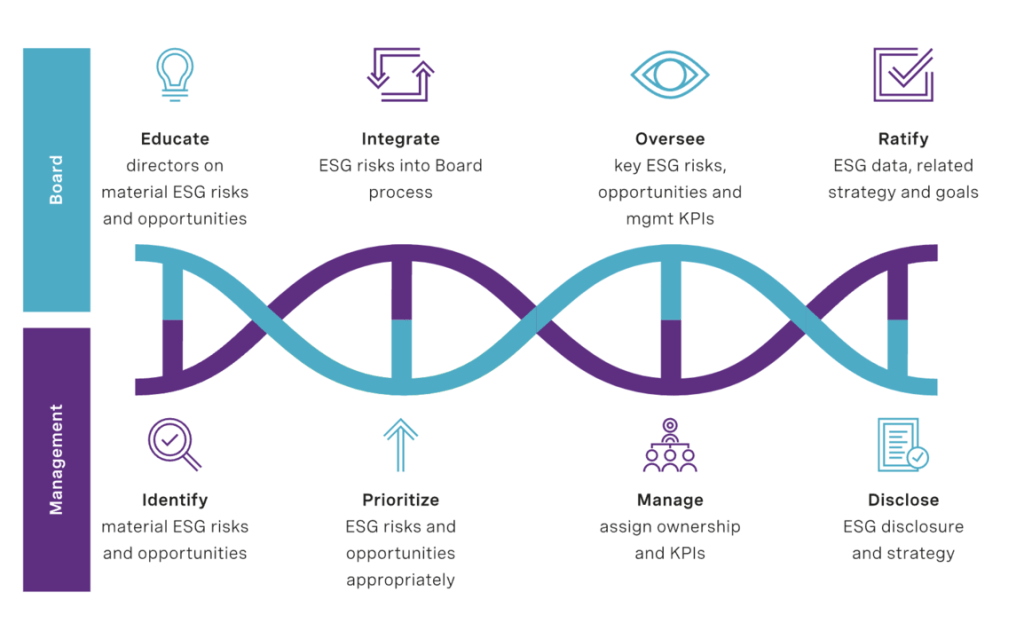

Roles of the board in ESG reporting

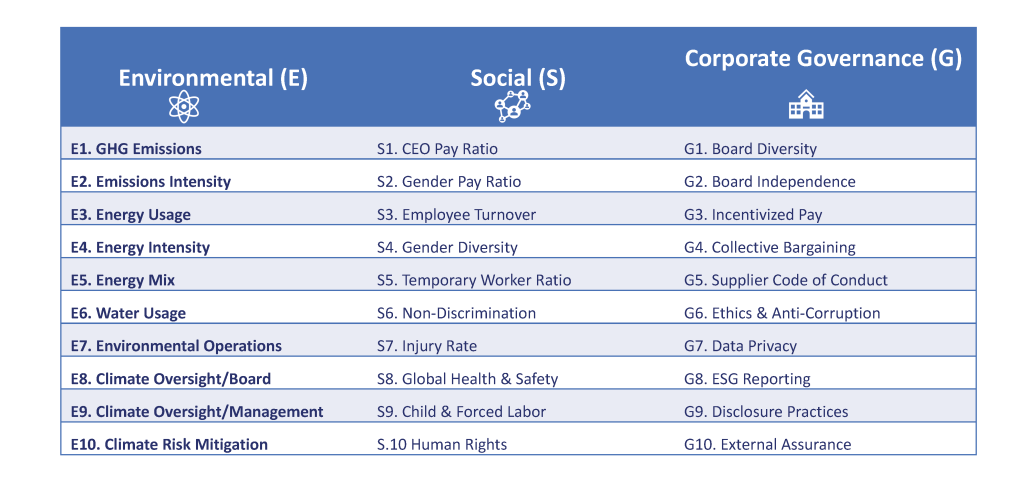

According to Dr. Kariuki Muigua, PhD, the ESG Manual requires Boards of Listed Companies to facilitate integration of ESG into strategy, operations and performance management. In addition, a committee of the Board that oversees sustainability matters in the organization, including the ESG reporting process, should be formed. Therefore, boards must prepare for the new normal, and some of their roles and practices include:

- Defining ESG oversight and governance structure

- Developing formal ESG responsibility in the management

- Aligning ESG plan with strategic goals and KPIs

- Understanding ESG risks

- Understanding the company’s ESG maturity level

- Adoption of an ESG Framework

- Full disclosure of ESG expectations

5 ways the board can Develop ESG Expertise

Until now, corporate boards have been relying heavily on external consultants for ESG advisory and education. However, having specialist advisors can be counterproductive if the board is always relying on them.

Also Read: The Importance Of Sustainable Leadership in the Business World

Directors possessing a comprehensive awareness of the diverse responsibilities of the board and a profound understanding of their firm’s industry are better equipped to be effective in the oversight of key ESG risks and opportunities relevant to the company. Therefore, there is a need to take a more diversified approach to meet the demand of developing and introducing in-house ESG expertise. ESG scholars and expert advice suggest the following approaches.

- Pair up board members with internal ESG experts or executive for learning and mentorship to help advance the collective ESG expertise of the board.

- Initiate open discussions with the board on aspects where the organization is compliant with ESG principles or taking an industry leadership position.

- Organize periodic sessions where the CEO shares short-term and long-term wins gained from compliance with ESG and sustainability leadership.

- Sensitizing and encouraging the board to seek education on ESG which may comprise of sharing information on ESG programs and seminars.

- Identifying board-ready corporate executives from the organization with ESG expertise and adding them to the board.

Conclusion

The board of Directors have a critical role to play in leading their organizations’ ESG plans. Understanding the risks and opportunities associated with ESG, while ensuring that their companies are well-positioned to thrive in a world that values sustainability and social responsibility.

By attaining ESG expertise, aligning ESG strategies with overall goals, and fostering a culture of sustainability, boards can not only meet investor expectations but also safeguard the future viability and success of their organizations. It’s time for board members to step up as sustainability leaders and embrace the imperative of ESG reporting in-house, so as to navigate the challenges and opportunities of the future.

To learn more on how to implement ESG and Sustainability Leadership, contact us today.